Enjoy our editorials? Check out our new podcast above!

For more than three years, a fenced-off 3.3-acre lot in the heart of downtown Fort Lauderdale has sat dormant. Once the city’s permitting office and long envisioned as a public park, it is now the subject of public outrage and scandal. The culprit: a failed public-private partnership known as One Stop FTL. What began as an unsolicited proposal from nightlife promoter Jeff John has devolved into a case study in poor governance, backroom lobbying, and phantom financing.

The City owned One Stop Shop land, worth an estimated $35 million, was handed over to a private developer through a 99-year control agreement that allows for no property taxes and requires no rent until after a certificate of occupancy is issued. While this in and of itself is rather common, the fact there is no deadline to commence or complete construction is not. So until something is built (if it ever is) and gets its certificate of occupancy, the developer owes the city nothing. This explains why no shovels have hit the ground. As long as the developer avoids triggering the C/O, the site remains a rent-free holding, and a prime downtown parcel sits fenced off, unused.

Phantom Financing, Real Consequences

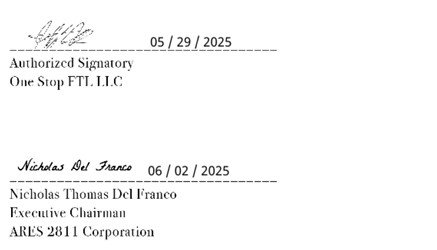

Residents, journalists, and even (some) commissioners have demanded answers. But as of today, we’ve seen no credible proof of financing. In fact, when pressed during a May 2025 meeting, developer Jeff John couldn’t provide the supposed “commitment letter” he had shown staff. This editorial site revealed a suspect financing letter obtained through a public records request from a New York company with a residential address called Ares 2811, Corp. The Sun-Sentinel commented that the letter was suspect and looked “phony.” At the last meeting on the issue, the developer couldn’t even say who his financing was from and was unsure if he had an arrangement with BGC Group or BCG Group. He brought another individual along who had just as few answers.

When Commissioner Herbst asked directly if the funds were coming from BGC Group, formerly Cantor Fitzgerald, the response was stunning: “I have to verify that.”

It’s also worth remembering that then City Auditor John Herbst was fired by Mayor Trantalis, Commissioner Glassman, and Commissioner Sorensen, largely because he raised concerns about this very deal. Voters responded by electing Herbst to join them on the dais. The point is simple: this has been a bad deal from the beginning. And when bad deals aren’t promptly terminated, when ineffective commissioners hesitate to act even when the law and facts allow it, they don’t fix themselves. They get worse.

Meet the Mystery Financier

When we first uncovered the Ares 2811 Corp. letter, the most suspicious detail was its signature — simply “Management,” with no individual name, no contact information, and no accountability. Even more troubling, the letter misspelled the name of the project’s main contact.

Thanks to public records and investigative follow-up, we now know why.

A newly disclosed document, the “Final Development Agreement,” dated May 29, 2025, does have a name and reveals that Nicholas Thomas DelFranco is the man behind Ares 2811 Corp.

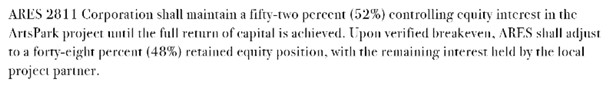

And, pursuant to the same agreement, Ares 2811 Corp. will hold a controlling 52% interest in the entire project.

The Final Development Agreement claims that “All funds required to finance this project shall be sourced and deployed through ARES [2811 Corp]’s institutional funding channels.” With $58M to be deployed in year one, $79M in year two, and the remaining $55M as a credit reserve or operational facility.

But, Who is Nicholas Thomas DelFranco?

DelFranco maintains two nearly identical websites—nicholasthomasdelfranco.com and delfranconicholas.com— where he calls himself a “a successful Business Entrepreneur who has founded many different companies in a variety of fields.” Click through his bio and you’ll find page after page of vague praise, no actual names of companies he’s started, and every article authored by himself with source links to other sites with more posts he’s drafted about himself. It’s a hall of mirrors—not a resume.

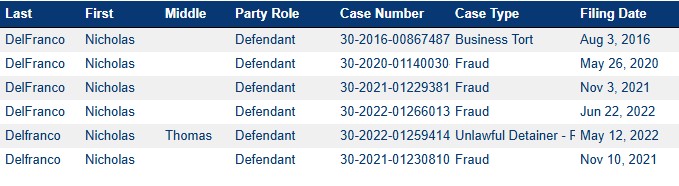

A Trail of Lawsuits from Coast to Coast

His past includes multiple lawsuits alleging investor fraud, bounced checks, and vanishing inventory, with complaints filed from New Jersey to California. Three separate posts on RipoffReport.com tell a story of a man allegedly using aliases, operating shady online storefronts, and conning investors with promises that evaporate faster than his product lines.

In a 2016 lawsuit filed in California, a businessman named Harry Berkowitz accused DelFranco of orchestrating a brazen fraud involving a cannabis grow operation. After personally soliciting a $63,250 deposit to supply hydroponics equipment for a Denver facility, DelFranco allegedly delivered just four pumps valued at a few hundred dollars and then disappeared with the cash.

In 2020, in a separate California lawsuit, entrepreneur David Wise alleges that Nicholas and his father Thomas DelFranco engaged in a fraudulent scheme involving the sale and delivery of over $3.8 million in farm supplies intended for a hemp cultivation venture. According to the complaint, DelFranco repeatedly misrepresented his intent to pay and even issued a check for $42,035 that was returned for insufficient funds. Wise asserts that only a fraction of the promised crop was planted (70 of the agreed upon 1000 acres) and that Nicholas and his father failed to return the unused inventory. The complaint seeks damages exceeding $3.7 million, and alleges causes of action for fraud and conversion, describing a pattern of deception, broken promises, and personal enrichment at Wise’s expense. Another investor, Trevor Hill sued for the same incident not long after.

The following is just a sample of the lawsuits filed against him in Orange County, California alone…

Also in 2020, he was sued in a lawsuit filed in Oklahoma County alleging he took nearly 630 pounds, approximately 21 million seeds, of a marijuana strain known as “Trump 1” without paying the agreed $3.68 million purchase price. According to the complaint, the seeds were delivered by Oklahoma-based 4th Dimension HC to DelFranco, who then flew them to Colorado and never paid for them. The lawsuit alleges fraud, theft, misrepresentation, and breach of contract.

In 2022, he was sued by his landlord for eviction for failing to pay his rent. The plaintiff alleges that Nicholas Thomas DelFranco and his associate entered into a lease agreement for a luxury residence in Irvine, California, agreeing to pay $17,000 per month. Despite this, they allegedly failed to pay two months of rent totaling $34,000 and refused to vacate the premises after receiving a three-day notice to pay or quit.

It seems unlikely someone with his history of litigation could pass a commitment committee for any credible institutional investor in order to be able to borrow a hundred million dollars.

Catch Him If You Can

Much like a real-life Catch Me If You Can, Nicholas DelFranco has zigzagged across the country, leaving a trail of lawsuits in his wake from New Jersey to Oklahoma to California. Now, somehow, he’s landed in Fort Lauderdale and will have a controlling stake in city-owned land worth tens of millions. And this is the man now slated to control the majority interest in one of Fort Lauderdale’s most controversial public-private developments. What could possibly go wrong?

And like Frank Abagnale, whose exploits inspired the film, DelFranco appears to have learned the game from his father, Thomas, who is named as a co-defendant in several of the alleged schemes. One warning posted on RipoffReport puts it bluntly: “if you know these supposed ‘Business people’ run…run as fast as you can. They will do whatever it takes to further themselves without ever doing one thing that they promised. If you are working with them or thinking or leasing or selling them property or trading or giving your money…. Do your research. Contact past landlords in Michigan or Florida. Call their previous investors, ask for anything to prove they are who they tell you they are. I wish I did.”

These are exactly the types of people drawn to cities where bad governance and lobbyist-controlled politicians create the perfect conditions for exploitation, where oversight is weak, consequences are rare, and public land is treated like a private playground.

We’re doing our homework. Unfortunately, some of our city leadership is not.

District Commissioner Steve Glassman did not respond to our request for comment. However, as recently as last month, he continued to champion this project. He insisted on giving the developer more time, more leniency, and more benefit of the doubt than any rational steward of public assets ever should. But let’s be clear: the developer failed to meet its original obligation to demonstrate financing within 90 days of signing the agreement in 2022. They failed again to show proof of financing within 30 days of the city’s formal notice of default, after the City Commission declared the project in default on May 6, 2025. And now we’ve learned of a controlling interest quietly transferred to Nicholas DelFranco, an individual never disclosed in the original proposal, raising serious questions about whether the change of control itself constitutes a separate breach of the agreement.

*Although none of the lawsuits we reviewed resulted in a judicial finding of wrongdoing, the consistent pattern of allegations, including bounced checks and misrepresentations in business dealings, raises serious questions about DelFranco’s business practices.

Sadly, not surprising. Most importantly, what can be done? Is the 52% transfer legal? Is that what constitutes securing financing? How soon can this be discussed before it gets any weirder?

Wow! This editorial is amazing! Bravo. People need to demand that their elected officials immediately restore full ownership of this public land back to the rightful owners — the people of Fort Lauderdale. This land giveaway is no less egregious than the thank God failed plans to put golf courses, pickle ball courts, etc. in our state parks.

I’m familiar with the property you are referring to. There must be some individual out there who would like to take on this project. There certainly is enough evidence to put this person in jail . I would be glad to help.

Disgusting lack of due diligence by Fort Lauderdale’s elected officials for giving away public taxpayer land to a con man. It’s a cover-up and instead of enforcing a development agreement they chose to allow it to fester.

he screwed me out of 600k

From Day 1, the development project was a SHAM, due to a an inexperienced operator, lack of credible financing & a questionable leasehold/develp[emtn agreement. Yet, despite all evidence to the contrary, the City decides to extend the agreement to a “documented” fraudster who is unable to produce a “PROOF OF FUNDS” document from a bank or accredited financial institution.

Us the taypayers have spoken against this project again an again

What city government with integrity would ever allow this to continue. The developers have had 3 years an now they give them another 80 days when is enough enough

I drank the Del Franco’s koolAid during the height of the cannabis craze…even after hearing of the the potential of a scam… Nick plays the game of wealthy land owner with the promises of prosperity just a $150k away!

He even hired me to run “Packs” 1lb. and “boxes” 100 lbs. of Humbolts finest underground…grown outdoors….. to feel whole! Then made me a partner in a “licensed” grow…. Little did I know…. Every one of these opportunities was hi-dollar Ponzi scheme funded by people just like me…. Del Franco got me and my group of friends for over $1million dollars!!! How? He would Divide and conquer! No one knew the others were being groomed for the same slaughter! He’d wait til he had you alone and offer the best deal Yet on a large grow, oil, CBD ….you name it! Not one deal ever made $!

Nick had the knowledge and ability to succeed at every thing cannabis but chose to lie, cheat and steal millions from trusting soles and just disappear wout a trace ….to his next victims…New York, Hawaii, California, Colorado, Las Vegas, Oklahoma now Florida! Many more…. Judgements followed and running from RICO charges!!! A Bad Human Being cant evade Karma!

If you see the name Nick Del Franco your dealing with the devil!!!